Estimated reading time: 5 minutes

A Brief Discussion on Commission Received Journal Entry:

The accounting treatment to Commission Received Journal Entry is similar to any other income Journal Entry. It is an income to the entity against providing some services or making affiliate sales.

How about an example to understand this concept?

ABC Company is into the real estate business. It had launched a new project with 1000 plots of land, and each plot area equals 500 square yards. The price for each plot is Rs.18,000.

The real estate business wants to get back its capital as soon as possible. So, they employed agents to push for more sales and reach the break-even point. Company pays agents @ 25% on the sales price of plots sold.

If a Marketing agent can sell two plots, the Percentage of Commission received will be Rs.9,000 (Rs.4,500 per plot).

In this example, marketing agents received Commission against making real estate plot sales.

LIC agents are another Classic example of commission agents that we see daily. Of course, Aggregators like Policy Bazaar are replacing these agents

Table of contents

What’s the Commission Received Journal Entry?

The two General Ledger (GL) accounts that come into play for this transaction are

- Commission Received and

- Accounts Receivable or Debtor.

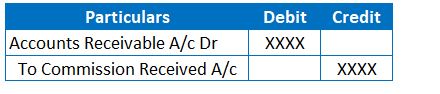

Journal Entries in the books of the agent who receives the Commission is below along with explanation:

JE 1 – Recording the commission services transaction

Understanding the Journal Entry 1:

Commission Received being income is a nominal account. Nominal Account’s golden rule of accounting is to debit all expenses and losses and credit all incomes and gains.

There is a need to recognize the receivable if there is a credit period for payment. So, debit the accounts receivable because the Real account’s golden rule of accounting is debit what comes in, and credit what goes out

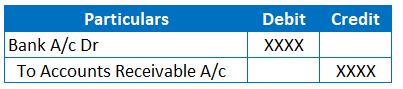

JE 2 – Recording the payment

Understanding the Journal Entry 2:

Above entry is to account for the Cash received against the Accounts Receivable. The GLs involved herein are Bank and Accounts receivable. These two GLs are real accounts. So, we shall debit what comes in and credit what goes out. Agents will be receiving cash/bank and let go of the asset account. In other words, Accounts receivable asset replaces the Cash GL. So, entity records journal entry by reversing AR GL and increasing Bank account.

Runners Insight:

Let’s learn the logical aspect of this second entry. We need to increase cash and decrease accounts receivable. The Easy rule to remember for any Journal entry involving asset is

To increase any asset – Debit the asset GL

To decrease any asset – Credit the asset GL

We already have the Accounts receivable Debit in the Journal entry. So, Credit the Receivables in Journal entry to reduce it. Cash GL is nothing but the fill-in-the-blank for the entry. If AR is on credit side, then the debit side is only the leftover portion. Therefore, Cash/Bank GL is debited. Therefore, we can be logical as well to record the journal entry.

In the initial example, we understood the journal entries in the books of entities receiving the Commission. Let’s see the entries in the entity’s books which is paying the Commission.

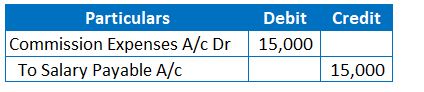

Practical Example – for Commission expenses

TTT is a cloth dealer and pays his employee’s salaries with fixed and variable amounts. Variable amounts depend on the sales made and are calculated as a percentage of the total sales value created during the month. The Percentage of Commission is 15%.

Sales Details are:

Total Value of Sales made by an employee = Rs.1,00,000

Percentage Value of Commission on Sales = Rs.15,000

Journal Entry:

Commission is paid by the TTT manufacturers and received by employees. Let’s see the journal entry in the books of the entity TTT below.

The two GLs in this transaction are the Commission expenses account and Bank or Liability account.

(Commission expenses A/c is a nominal account, and Salary Payable is a Personal Account. So, the Former GL is debited, and the latter one is credited)

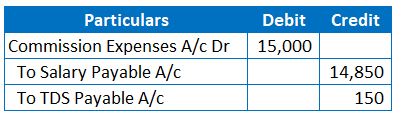

What’s the Journal entry if there is any TDS element involved?

Lets assume TDS rate as 1% on the total commission for recording entry

The payment is apportioned between employees and the government in the above entry. So, there is a split between the credit side GLs. Irrespective of the recipient, there is no change in the expenses account value. Therefore, debit side GLs do not get affected.

Once the Payments are made, the Salary Payable and TDS payable GLs are debited for respective amounts with a corresponding credit to Bank Account.

Conclusion for Commission Received journal entry :

The Commission received is income and is credited in the journal entry with a corresponding debit to accounts receivable or Bank if no credit period is allowed for this transaction.

Recommended Articles:

Accounting isn’t a rocket science. The key aspect is to learn the golden rules and spend time in understanding the various journal entry. We have listed down below a couple of JE articles: