Any Entity needs Capital to achieve its primary business objective. Owners bring Capital into the business either as Equity Shares, Preference Shares, Capital from the Partners (if the entity is a partnership firm), or debt/financings from borrowers. We will learn some basic concepts before moving on to the main topic – “Started Business with Cash Journal Entry”.

Table of contents

- What do you mean by Capital?

- Started business with Cash Journal entry:

- Analysis for the Started business with Cash Journal entry

- Examples for Started Business with Cash Journal Entry

- Frequently Asked Questions:

- What journal entry does a company make to record a cash investment by the owner in exchange for common stock?

- Conclusion

- Recommended Articles

What do you mean by Capital?

Capital is a Cash Paid to an entity against Shares or Interest in the business. The interest here means direct or indirect right to participate in the day to day operations. For Partnership firms, its a direct right. However, if the entity is a corporate body then the share holders can become board of directors and engage in the business operations. There can be interest payments to the Partners and dividends to the shareholders for Capital contributions.

Partners can bring in Capital either in the form of Cash or Assets (Applies only for partnership firms). For example, ABC is a Partnership firm with three partners, A, B, and C.

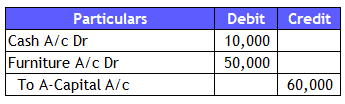

Partner A brought in Capital in form of Cash of Rs.10,000 and Furniture worth Rs.50,000. Then we need to record the asset and cash as debit along with a corresponding credit to the partner A Capital.

Let’s See the Capital entry in :

Started business with Cash Journal entry:

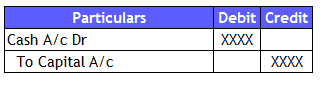

Now we have a good understanding of basic concepts. So, we can move into the main topic of “Started business with Cash Journal entry .” The focus here is starting a business with the capital contribution in the form of cash. The Journal entry to record the cash brought in for commencing a business is below.

How is the above entry recorded?

We record entries as per the Golden Rules of Accounting. These rules define the foundational step of deciding whether we need to debit or credit a GL Account in the journal entry. Such rules categorized GL accounts into three, and those are below:

Personal Account

GL Accounts which relate to Natural Persons (like Ram, Suresh) , Artificial persons (like LLP, Company) and Representative Persons like Capital Account, Drawings Accounts, etc., fall into Personal Account Category.

Rule: Receiver and Giver will be debited and credited, respectively.

Also Read: True Up Journal Entry

Real Account

GL Accounts which are of an asset nature like Cash, Furniture, etc., fall into Real accounts.

Rule: Debit What Comes in and Credit what goes out

Nominal Account

All Incomes/gains or Expenses/losses fall under this category. However, our transaction does not include any nominal accounts.

Analysis for the Started business with Cash Journal entry

We will understand how to identify each GL that is part of the transaction and then apply the golden accounting rules. The two accounts in this transaction are cash and Capital.

Cash is a real account and is coming into the business. As such, we will debit it in the journal entry.

Capital is a Personal account and is a giver to the business. Therefore, we will credit it in the journal entry. These are the steps needs to be followed for recording any entry.

Examples for Started Business with Cash Journal Entry

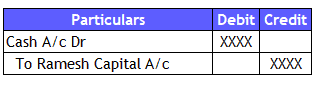

1. Ramesh started business with cash. What’s the Journal entry?

The transaction results in two GL’s Cash and Capital accounts. The journal entry to record this transaction is the same as the above. However, there shall be a clear description of the Capital GL accounts. Instead of recording as just Capital Account, we can record it as Ramesh Capital. This helps distinguish the records of each partner if there are more than one partner.

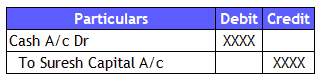

2. Journal entry for commenced business with cash by Suresh

Commencement of business is nothing but starting a business. The entry will be the same as in the above example, but the GL Description varies.

Frequently Asked Questions:

What is the entry for cash invested to start the business?

We will record the entry by debiting cash and crediting capital accounts.

How do you record beginning cash balance?

Personal and real accounts will not close down in a year, and these will have a running balance. So, we will carry forward the assets and liabilities GL accounts to the following year. We need to bring in the cash balance from the previous year. Nowadays. The accounting packages have a feature to bring those balances into the current year automatically.

We need to debit the Cash GL as the inflow of funds increases its balance.

Also Read: Cash Coverage Ratio

Which are the two accounts involved in the transaction started business with cash?

Cash and Capital accounts are two GLs that part of this ‘started the business with a cash’ transaction.

What journal entry does a company make to record a cash investment by the owner in exchange for common stock?

Cash investment by the owner in exchange for the common stock has two GLs – Cash GL and Equity share capital GL, if it’s a Company or Capital GL in the case of the partnership firm.

Debit the cash and Credit the Capital accounts.

Conclusion

Started business with cash journal entry records the initial Capital brought into the business. We will record it by debiting the cash against credit to the capital account. Per Golden Accounting rules, we will debit the cash as its coming into business and credit the Capital GL as its the giver.