Want to understand how to record the free sample journal entry?

Lets understand this with real time example.

Have you remembered receiving some freebies for purchasing a product?

For example, you noted a buy 1 get one offer for a Perfume. Here, the Second Perfume is a good, given as a free sample.

Such goods distributed are nothing but a kind of advertising charge.

Let’s see how to record such goods distributed as free sample journal entry.

The GL Accounts Goods and Advertising Charges are part of this free sample distribution journal entry. Its general practice is to record the Inventory/Goods Procurement and Sales to the Purchase Account and Sales Account. So, there will not be any Goods Account as of such.

We can’t count the free sample distribution as a Sale, and it will result in an inappropriate increase in the revenue balance.

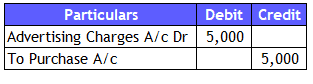

Instead of hitting the Sales Account, we will record this transaction by crediting the purchase as the goods are going out. If goods are distributed as a free sample, then those goods will not be available for production or resale. Therefore, it’s appropriate to reduce the purchases account by crediting it in this free sample journal entry.

Every year the amount spent on the marketing is increasing. Business entities are finding innovative ways to market the product. To understand the increase in spend, refer to this article on digital ad spend.

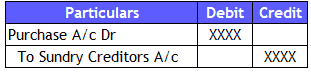

What’s the entry to record the Procurement of goods?

Procurement of goods involves Purchases and Vendor Payable or Sundry Creditors. Purchases are Expenses, and Sundry Creditors are Liability.

Per Modern Rules of Accounting,

If we want to increase an Asset or expense GL account, we need to debit it.

If we want to increase a Liability or Income GL account, we need to credit it.

Goods distributed as free sample journal entry

We will learn how to record the Goods distributed as free sample entry with an example. Assume that Spoil Company received 100 No’s of Smart Phones Costing $1,000 each. The Company is in the business of resale of Smart Phones. The Company wants to promote its business by organizing a game show where the winners will get a Smart Phone. There will be five winners.

Therefore, the Company spent $5,000 promoting its business to boost its presence. We need to record the Advertising Promotion Charges in the books of accounts by reducing the purchases and increasing the advertising charges.

Runners Insight:

Frequently Asked Questions:

When goods are distributed as free samples, it is treated as?

Such distribution of goods as free samples is a kind of business or product promotion expense. So, we need to treat them as Advertisement Charges or Marketing Expenses.

Which account is debited when goods distributed free sample?

Free Samples distribution results in moving stock of goods from entity factory or Go-down, and such transaction increases entity visibility like an advertisement. So, we will debit the advertisement charges when there is a free sample distributions

What type of account is goods distributed as free sample?

The goods can be primary stock or any other items. For example, an entity is in the business of selling Laptops. So, the entity runs a lucky draw campaign to promote its products and business.

An entity might also distribute Free T-Shirts with the business names printed.

Also read: Goods given as charity Journal entry

Will be credited if goods are given as free sample

Yes, we need to credit the purchases for recording the distribution of the free sample. Providing free samples results in reducing the stock in hand for the entity. So, we will facilitate the purchases already made.

How do you record free goods in accounting?

Free goods are a business promotion expense. So, we will debit the advertisement charges and credit the purchase account.

What is the journal entry of rent paid?

Record the Journal entry for rent by debiting the rent expenses and crediting the bank account. Refer to jrent paid article for more insights

Is free distribution of goods is debited to trading account?

The main reason for goods distribution as free samples is to ensure the entity products have a broad reach. So, it’s like Sales Marketing or Advertisement expenses. As such, it is not part of trading activity. But we need to record it in the statement of profit or loss.

What is the journal entry of goods lost by fire?

Goods Lost by fire will also reduce purchases, and it’s a business loss. So, we will debit the Loss and credit the purchases.

How do you write off a product sample?

Writing off a product sample means providing the goods for promoting it. So, it’s a promotion expense, and we will debit it with a corresponding credit to the purchases.

Summary – Goods distributed as free sample journal entry:

Goods given as free sample to ensure the product and business is more reachable to the customers. So, it an advertisement expense. We will debit the advertisement account and credit the purchases to reduce the stock distributed as free sample